Decred

Decred uses a hybrid PoW/PoS method of reaching consensus, PoW miners perform the same basic function as in Bitcoin but the network’s rules are designed to give PoS voters power over the miners.

Decred defines a constituency of stakeholders that have collective responsibility for governing the network, and embeds mechanisms through which this constituency can make and implement decisions. Holders of DCR (Decred’s native asset) can time-lock it in exchange for tickets, and voting with these tickets is integral to block production and decision-making. The rationale is that people with locked DCR balances have skin in the game and are incentivized to look out for the network’s best interests.

Consensus

PoW miners compete to solve random puzzles and create new blocks, providing security for the network and collecting 60% of the Deced block reward and all transaction fees. PoS voters are pseudorandomly called to vote in each block, and the blocks are not recognized as valid by the network until at least 3 (of 5) tickets called have voted, but miners don’t get their full reward unless all 5 tickets vote. Tickets vote to approve or reject the contents of the previous block, giving them the power to reject a miner’s block for a specific reason and withhold that miner’s reward, without interfering with their own reward.

The requirement that each block have the active participation of at least 3 (of 5) randomly selected tickets makes the network more robust to majority attacks 1 than a PoW network with equivalent security spend. This is because selfish/secret mining is impractical without controlling a significant share of the live tickets and ticket voters will not vote on blocks that would result in a significant reorg 2. In effect, PoW and PoS constitute a two-factor approach to security, where an attacker must compromise both factors to succeed. PoS voters receive 30% of the block reward in exchange for the service they provide in improving the network’s security and participating in governance.

The requirement that each block be shown to ticket-holder constituency before it can be completed and broadcast means that the blockchain must be constructed, block by block, on the commons. This is in contrast to pure PoW blockchains, where a competing chain can be worked on in private and then released on the network whenever its miners choose. In a network with pure PoW consensus, nodes willingly abandon their view of the blockchain’s state when presented with a longer Proof of Work chain. Staking Decred nodes have weight on the network, they approve every block and will not vote on blocks that would cause a significant reorg, giving them the collective power to reject such attempts.

Decred tickets are also part of a formal decentralized method of approving and adopting changes to the consensus rules. To trigger this process the nodes run by PoW miners (95%) and PoS voters (75%) must upgrade their software to a new version which incorporates a latent set of changes to the rules. For a period of ~28 days every ticket that is called can vote to approve or reject the proposed changes, if at least 75% of voting tickets approve the changes then they are activated 28 days later. This means of coordination ensures that Decred can deploy hard fork upgrades smoothly in the case where they are supported by ticket-voting stakeholders.

Funding

Development of the Decred project is funded by a Treasury which receives 10% of the block rewards. Ticket holders vote to approve or reject proposals for how those funds should be spent, and these decisions are implemented by paid contractors. An LLC entity called the Decred Holdings Group is in charge of making the payments from the Treasury wallet. Decred plans to subject monthly spending to a ticket vote, giving the ticket-voting collective ultimate authority over this aspect of the project as well.

Decred’s funding model can be understood as an attempt to merge conventional approaches to FOSS development with an autonomous funding source, towards the broader objective of building a robust network. To isolate the weakness of centralization, the project seeks ways to entrust a decentralized collective with overseeing the development of the network, making decisions about the common pool resource itself and how the available funds should be used to improve it.

The degree of control that stake-voters exert over Treasury funds is deliberately loose, confined to signalling approval or rejection of proposed spending (and in the future approving each aggregated monthly spend). Proposals which are intended to dictate how contributors (e.g. wallet developers) approach their work are not allowed. Anyone who a proposal relies on must be voluntarily on board for it to be valid.

This approach is intended to preserve the autonomy of contributors and create a good working environment and incentive structure. From the intrinsic/extrinsic motivation perspective, Decred’s approach seems to strike a good balance between the autonomy of contributors and the need to maintain cohesion within the project’s funded work. Extrinsic rewards (payment) are available but the degree of control exerted over contributors is minimized. Stakeholders control this at a strategic level by voting to approve or reject programs of work and their associated budgets.

Paid contributors to Decred are referred to as contractors, and contractors can be either individuals or corporations (which employ a group of contributors). Contractors submit monthly invoices to be paid for their work.

On the surface this appears as production which is coordinated through contracting with external parties, but in practice the “contractor collective” exhibits some of the same characteristics as a firm with employees. New members are invited to join when they have contributed work to some of the funded projects and the other contributors to those projects find their work to be of an appropriate standard. Individuals may also approach the stakeholders directly to seek approval for funding of their work, by submitting a proposal. The conventional approach of receiving applications and conducting interviews is eschewed in favour of demonstrated ability to make valued contributions.

There is a clearance process whereby a new contributor must be approved by established contributors in their domain before they can start billing for their work. Those other contributors within a domain will also have the power to revoke a contractor’s clearance - with a method of escalating disputes to a vote of all contractors, and from there to a stakeholder vote if necessary. The intention is to allow groups working on specific aspects to function independently without hierarchical control from outside the group; while maintaining a degree of oversight and accountability which is needed to ensure that sub-projects stay on target and Treasury funds are not wasted.

Decred’s approach to managing its block reward Treasury is uniquely tailored to the FOSS context. Some of its founders and lead developers have experience of working on FOSS projects pre-blockchain, and on an independent implementation of a Bitcoin full node, and have witnessed the tragedy of the commons firsthand3. Decred’s funding mechanism has been developed to address a specific need, and the way it is administered is designed to minimize the friction with how FOSS projects operate. The great majority of these funds are used to compensate contributors to the various FOSS projects that make up the Decred ecosystem. The open source ethos runs deep within the project, as reflected in the project’s constitution.

Almost all of this work and the coordination around it happens on the commons, and Decred strives to create FOSS tools that offer new types of commons which facilitate this coordination. Politeia is a good example of this.

Politeia

Politeia is an off chain governance platform (modelled on reddit) where proposals can be submitted and discussed in an environment with accountable censorship, and an immutable record of proceedings is maintained. Politeia uses dcrtime software to anchor its data to the Decred blockchain every hour, ensuring that the administrators of the server cannot secretly distort its contents or censor particular points of view.

Politeia was developed because it was deemed necessary to allow for censorship of proposals and comments on the open governance platform - otherwise it would be vulnerable to spam and illegal content. The requirement of being able to censor inappropriate content necessitates administrators who can wield this power.

Ultimately, whoever runs the server that hosts a service has the power to inspect and edit its data/content. In the context of the governance of a decentralized project like Decred, this kind of power could be abused to pursue the administrators’ agenda. For example, by censoring proposals or comments that advocate for a course of action they deem undesirable, marginalizing members of the community who hold those views.

Politeia users get “censorship tokens” which they can use to prove that they submitted a particular proposal, in the event that it is censored by an administrator without public acknowledgement. There is also a small cost (~2$) associated with submitting a proposal (to prevent spam), and with creating a Politeia account - to make it more difficult to make multiple accounts to spam the platform or spoof support for some point of view.

The Politeia software is FOSS, with a specific instance being used to host Decred proposal discussion and show ticket voting outcomes. As the software is FOSS, there is no barrier to another group hosting a new instance in the case where the instance hosted by Company 0 developed some problem.

Company 0 is the organization that produced btcd and was a major force behind bringing Decred into being. A number of the project’s lead developers work for Company 0, but over time the proportion of work being done by other contractors has steadily increased, and Company 0 are now in the minority.

The data for public proposals and comments and up/down votes on comments is all available through a GitHub repository, allowing anyone to verify that the data is unchanged by using it to check that it matches what was anchored in the Decred blockchain. The presence of up/down voting functionality means that were these votes to be anonymous (as they are on reddit) only the administrators would be able to inspect them and selectively reveal them (e.g. to identify or accuse of sockpuppet voting). Politeia tracks these votes openly in the data repository, with the idea again being to make this commons as fair as possible for everyone who uses it to participate in Decred’s governance.

Politeia also serves as the basis for a Contractor Management System, which is used to collect, record and process the monthly invoices from contractors. This information too is recorded immutably (although not publicly readable), so that members are assured that the information they can access is uncorrupted. Invoices are cryptographically signed by their submitter and anchored in the Decred chain, there is no way to edit or delete them. Public aggregated spending summaries are also planned, and these will benefit from the same assurances.

Decred’s Treasury funds are used to further the project in ways other than software development, in recognition of the fact that the project is about building a useful public common pool resource. The nature of cryptocurrencies is that they get more useful the more people use them (network effects), and so promoting use of the Decred network is integral to this resource’s value. Work towards this goal is funded by the Treasury. In practice the stakeholders decide what the scope of the project is, both directly (by, for example, amending the project’s constitution) and indirectly by deciding which work should be funded. One of the most controversial decisions so far has been about whether to hire a specific PR firm (Ditto proposal), the proposal was approved and the firm’s position renewed for 6 months later with another proposal.

As noted above, this resource is itself also partially funded by the Decred Treasury, as part of an Open Source Research program (also recently renewed). This research program processes and analyses data from Politeia to produce insights about the platform that can be shared back with the ecosystem. It also looks beyond Decred to see how other projects are approaching the aim of decentralization, with the aim of learning from their successes and failures. Decred is actively working to inform its stakeholders and improve their collective intelligence, in the expectation that an engaged, informed and cohesive stakeholder constituency is where the network’s strength will be derived.

Membership of the stakeholder constituency is permissionless, it only requires enough DCR for a ticket (at time of writing in June 2019, around $3,500), and voting power is decentralized to a large and growing degree (see Distribution section below). All software and information goods are offered openly on the commons as public resources, ensuring that they are available to all stakeholders, and external observers (who could become stakeholders at any point).

Governance

The salient points about Decred’s governance are these:

- PoS ticket-voters contribute to block validation in a way which gives them authority over PoW miners

- ticket-holders vote to accept or reject changes to the consensus rules, on chain.

- ticket-holders vote to accept or reject budget and policy proposals, on Politeia.

- participation on Politeia through comments and reddit-style up/down comment votes is open to anyone that pays the 0.1 DCR (~$2) registration fee. Proposals cost 0.1 DCR each.

- work is coordinated through (almost universally public) Github Repositories and chat rooms (bridged between Telegram, Discord and Matrix). These chat rooms also play a role in governance, as they are where participants hold informal discussions about the issues at hand. I wrote up this analogy about how the various social platforms fit together.

Various stakeholder groups (miners, users, developers) comingle in this unitary stakeholder constituency, and have decision-making power commensurate with the amount they have at stake. This simplifies governance, as compared to a project where the various stakeholder groups have different affordances in how they can exert power over the project (sometimes resulting in an impasse or fracturing of the ecosystem).

Delegation

Stake-voters are integral to producing the blockchain but they do not directly drive the project, rather they open and close gates with decisions about the consensus rules and Treasury spending. The contractors working directly on the project have a different kind of influence on its progress and direction. Workers are in the first instance accountable to their peers, but as groups they are ultimately accountable to the stake-voter constituency. This can be thought of as a kind of informal delegation, but more a delegation of work than decision-making power.

Formal delegation is isolated to “Voting Service Providers” (VSPs). A VSP is a service that will vote on a stakeholder’s behalf when their ticket is called to vote on chain. When a ticket is called to vote it must respond quickly, and this means a wallet must be online and open at that time. When stakeholders buy tickets they can allow a VSP to vote on their behalf, thus delegating some of their sovereignty (but not custody of their funds) in exchange for the convenience of not having to continuously maintain open voting wallets on their own servers. Stakeholders decide how they wish their tickets to vote on any open consensus rule change proposals, and the VSP is responsible for voting in accordance with that expressed wish when the time comes (stakeholders can easily check how their tickets voted). Politeia voting is not delegated in any way, the holder of the ticket votes directly from their wallet.

Politeia has a limited role for administrators, who are charged with censoring spam and inappropriate proposals, and who control the start of voting periods.

Commons-based decision-making

Participation in Decred’s Proof of Stake component is relatively high, with around 50% of circulating DCR being time-locked in exchange for tickets at any given time circa mid-2019. Half of all the circulating DCR is represented by live tickets.

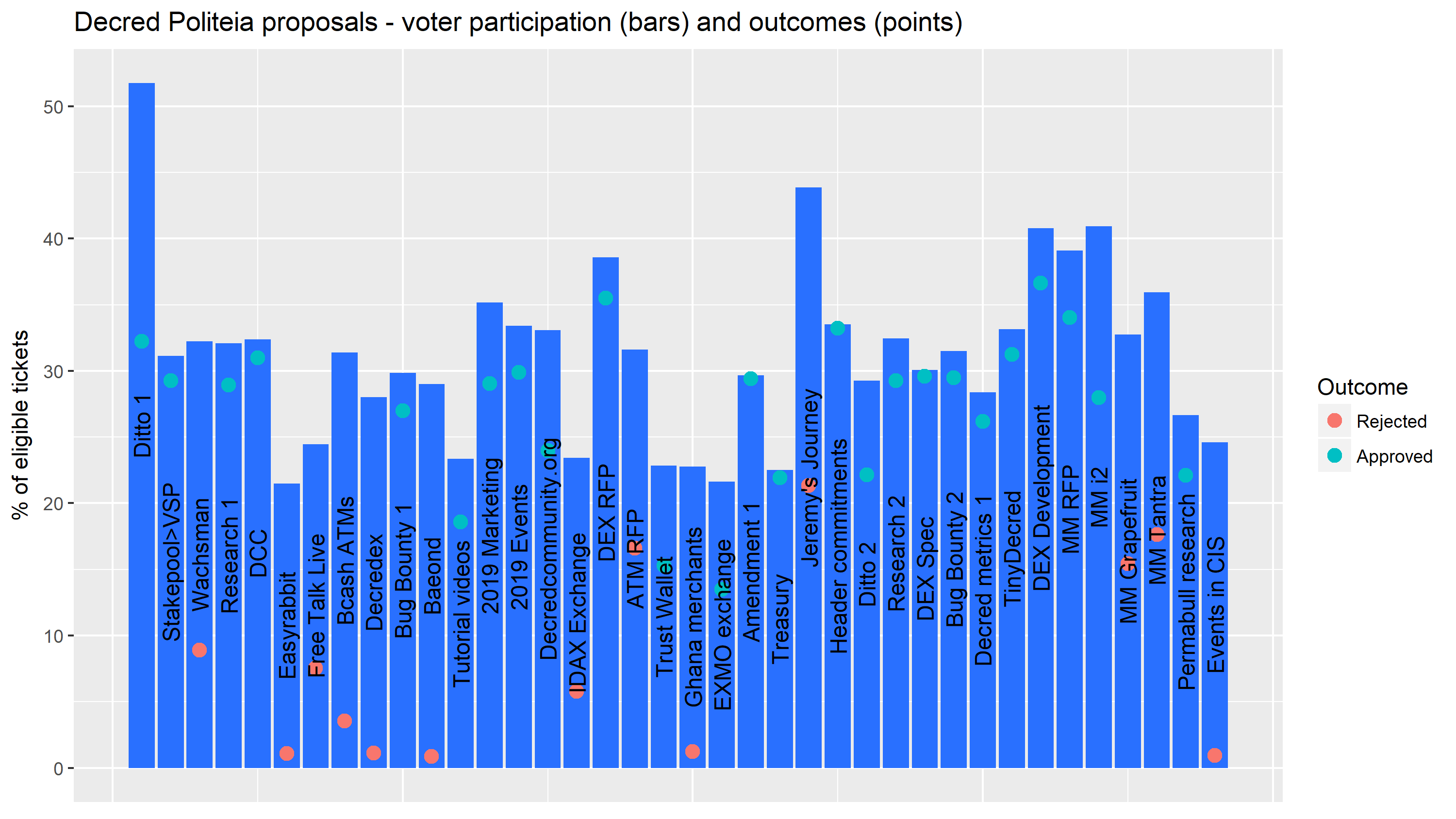

Starting in May 2017 , there have been 4 on chain consensus rule change proposals with mean active ticket participation (i.e. voting yes or no) of 69%. All of these have had near unanimous support as they represented uncontroversial protocol upgrades. One change may have proven controversial with miners if they had veto power within the system because it reduced the fees associated with ticket transactions.

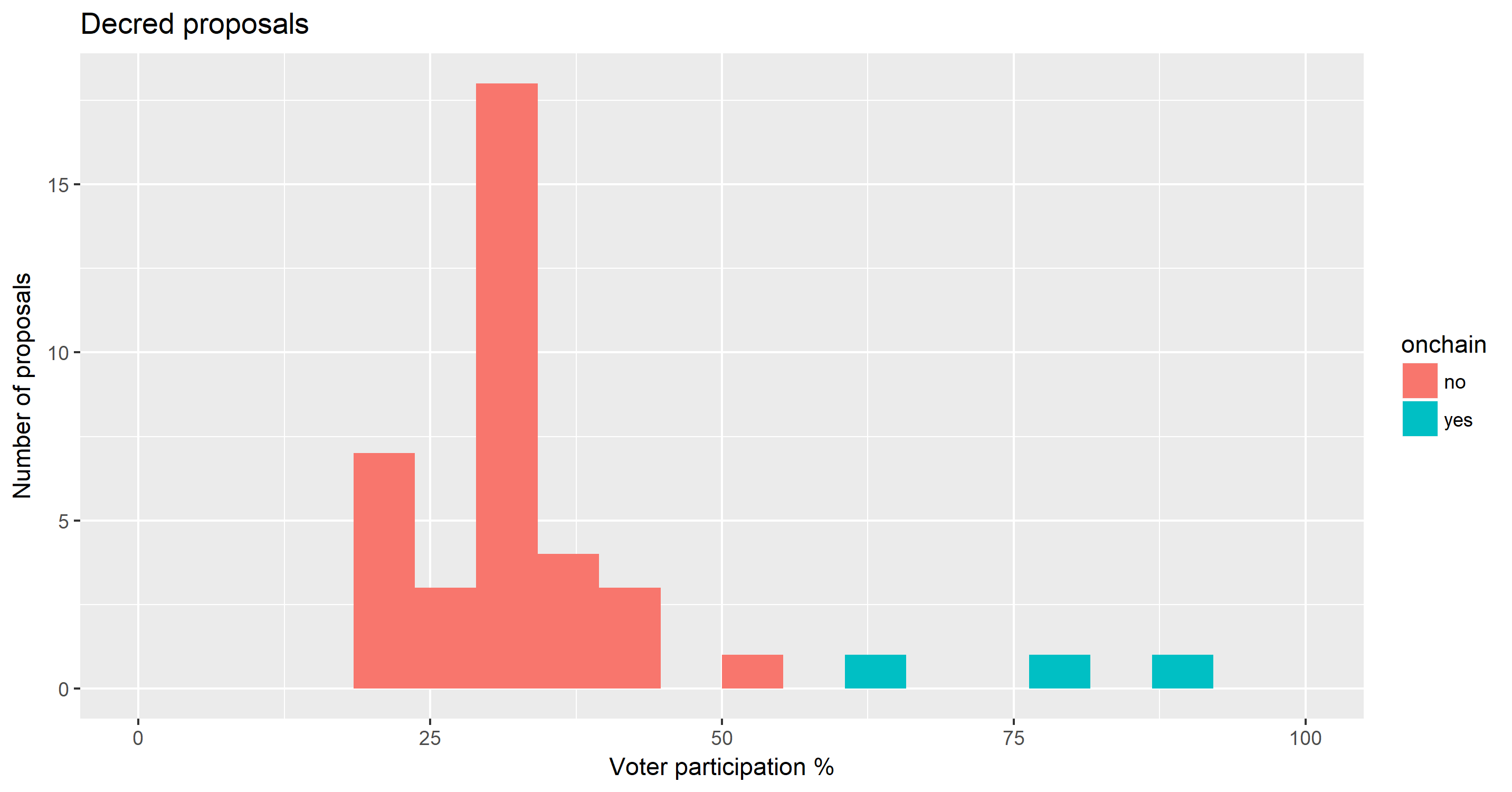

On Politeia, proposals that pass admin review are published for discussion, and can be edited by their owner as the discussion unfolds (with the platform maintaining a history of previous versions). When the discussion has reached a conclusion the proposal owner authorizes the start of voting and an admin triggers this week-long voting period. The proposal must be voted on by at least 20% of eligible tickets, and receive at least 60% Yes votes to be approved.

Politeia launched on Oct 16 2018, and after one year of operation 4 53 proposals had been published, 38 proceeded to a vote, with 25 approved and 13 rejections. Of the tickets that were eligible to vote on each proposal, there was a mean turnout of 31%. In the second year of Politeia’s operation 5, there were 46 proposals and mean ticket turnout was 28%.

Proposals have been approved which cover decisions like hiring a PR firm, approving a marketing budget, various research projects, DEX infrastructure, Python tools, a bug bounty, and policy decisions like a new contractor clearance process and an amendment of the project’s constitution.

The Decentralized Exchange (DEX) infrastructure proposals are interesting because they cross the boundary between cryptocurrency and DEX projects. The Decred community were not happy with the influence that centralized exchanges had on the cryptocurrency space, or with what other DEX projects had to offer (these usually introduce a token and charge fees so that the token has a purpose). Stakeholders voted to commission FOSS that would allow anyone to run a non-custodial client-server DEX based on atomic swaps and with a number of features to combat things like order spoofing and front-running.

In Oct 2020 the initial DCRDEX MVP was released 6, enabling users of the Bitcoin and Decred command line interface wallets to connect to a DCRDEX server and allow it to coordinate atomic swap transactions to execute trades.

I wrote about the first year of Politeia in a blog post](https://blockcommons.red/post/year-of-politeia/) 7. One of the stand-out trends was the degree to which the stakeholders approved proposals from people who were established contributors to the project, many of these achieving 90% or greater approval. The most controversial proposals were those which were competing directly against other proposals. A Request for Proposals type process was used to solicit competing proposals for the provision of public relations and market making services. In 2020, a formal RFP type of proposal was added to Politeia, this first seeks approval for a round of tendering proposals, which are then pitted against each other in a run-off vote.

Once Politeia proposals are approved, this is a green light for work to proceed and the worker(s) to bill according to the agreed schedule/rate as they complete it.

Distribution

It is not possible to know how many different people are represented among the Decred ticket-voters, but we can make some inferences by considering how DCR has been distributed.

Decred began with an premine and airdrop (description reproduced from previous section). 4% of the 21 million DCR total supply was allocated to the founders and another 4% airdropped for free to 2,972 participants who signed up following an announcement in the bitcointalk forum and picked up on Slashdot. In Decred’s case some form of premine was necessary to distribute DCR so that a decentralized set of users could buy tickets to power the PoS system. After a period of around 15 days (4,096 blocks) of pure PoW (in which time holders could get set up to vote) the PoS system automatically activated. Without a premine the early PoW miners would have dominated PoS as they would have been the only entities with DCR to stake.

In June 2019 after more than 3 years in production, 10 million DCR had been created, of which 1.68 million were issued in the genesis airdrop, PoW miners had received 5 million DCR (~50%), PoS voters had received 2.5 million DCR (~25%) and the Treasury had received 830k DCR (~8%). PoW miners typically have strong sell pressure to meet their operational costs and so it is likely that a significant fraction of the DCR they mined has been sold to cover costs. PoS voting rewards will have gone to people who received the airdrop, mined DCR or bought it on the market - then locked their DCR to buy tickets. Importantly, the proportion of new DCR going to PoS voters is low enough that they cannot maintain their share of the growing issuance or their representation in governance (number of tickets) just by staking.

References

- Zia, Z. (2019, April 3). Decred’s hybrid protocol, a superior deterrent to majority attacks. Medium. https://medium.com/decred/decreds-hybrid-protocol-a-superior-deterrent-to-majority-attacks-9421bf486292 [return]

- Red, R. (2019, January 25). The role of Decred voters in defending against majority attacks. Medium. https://richardred.medium.com/the-role-of-decred-voters-in-defending-against-majority-attacks-ec658af0a8fd [return]

- Yocom-Piatt, J. (2015). Bitcoin’s biggest challenges | Company 0.https://blog.companyzero.com/2015/11/bitcoins-biggest-challenges/ [return]

- Red, R. (2019, October 16). One year of Decred’s Politeia in numbers and graphs. Block Commons. https://www.blockcommons.red/publication/politeia-at-1/ [return]

- Red, R. (2020, October 16). Year two of Decred’s Politeia in numbers and graphs. Block Commons. https://www.blockcommons.red/publication/politeia-at-2/ [return]

- Mollen, F. (2020, October 21). Decred Announces its First Zero-Fees Decentralized Exchange: DCRDEX. CryptoPotato. https://cryptopotato.com/decred-announces-dcrdex-decentralized-exchange/ [return]

- Red, R. (2019, October 22). The First Year of Decred’s Politeia. Block Commons. https://www.blockcommons.red/post/year-of-politeia/ [return]